马达加斯加的货币供应量与通货膨胀相关关系研究

时间:2017-02-13 来源:www.51mbalunwen.com

Chapter 1 Introduction

1.1 Background, Objective of the study and Significance of the study

One of the macroeconomic challenges facing government in Madagascar has been the maintenance of the price stability. According to Jean paul Azam (2001) [1], the rate of inflation is the crucial proximate factor of the macroeconomic instability in Madagascar. even though Government and policy makers have recognized the seriousness of the phenomenon in the economy, and have developed policies to combat it, surprisingly, inflation is still uncontrollable. There has not been any remarkable success due to various constraints and problems such as the political instability, the instability of the MGA (Malagasy Ariary: currency of Madagascar)?s exchange rate, the increased fiscal deficit, and the inadequate policy implementation and coordination. Milton Friedman(1963) [2], the father of monetarism and laureate of the Nobel prize in economics, declared that “Inflation is always and everywhere a monetary phenomenon” and argued that the changes in overall price level are only brought about by the changes in monetary stock or money supply. Influence of changes in money supply over price level is a subject of controversy. For decades, the study of the monetary economy of a country has always represented an attractive topic for researchers. Despite several years of researches, the predicted relationship between money and inflation remains disputed in developed countries as well as in developing countries. Given the important role that plays inflation (or the price stability) in the economic development of Madagascar, and the predicted link between the money supply and the inflation, it is pertinent to analyze the relationship between the money supply and the inflation in Madagascar. This research study makes an attempt to study the relationship between the rate of growth in money supply and rate of inflation in Madagascar, over the period 1992-2012, with an empirical analysis conducted using a linear regression model. The estimated model is using data such as the inflation rate, the money supply, and the exchange rate) sourced from the International Monetary Fund?s International Financial Statistics, the national institute of statistics (INSTAT) in Madagascar and the Central Bank of Madagascar.

..........

1.2 Literature review

Most of the time, inflation is informally described as “too much money chasing too few goods”. This statement captures important aspects of why the money growth is linked to the inflation. Still, e. J. Hamilton (1993) [3], defines the inflation as an economic situation in which the increase in the money supply is faster than the new production of new goods and services in the same economy. According to M. C. Vaish (2002) [4], inflation is a sustained increase in the general price level caused by an elevated rate of expansion in the aggregate money supply. Inflation emerges in the economy on account of the rise in the money income of certain sectors of the economy without any corresponding increase in their productivity, leading to an increase in the aggregate demand for goods and services which cannot be met at the current prices by the total available supply of goods and services in the economy. Generally, money supply is defined as the whole amount of money existing or in circulation in a country. In other words, the money supply is, as of a particular time, the total stock of currency and other liquid instruments that households and firms can use to make a payment, or to hold as short-term investments in a country?s economy. The relationship between money supply and inflation is a very common debate in the economic literature. Many economists have analyzed the relationship among these variables over many years. At international level, such studies include A. J. Chhibber et al. (1998) [5] that employed a highly disaggregated econometric model for Zimbabwe.

..........

Chapter 2 Theoretical Research and Foundation

2.1 The concept of the inflation and the money supply

They found that the key determinants of inflation in that country are the monetary growth, the foreign price, the exchange and interest rates, the unit labor cost, and the real output. In a study for the African economic Research Consortium (AeRC), A. L. Kilindo (1997) [6] tried to enlarge our understanding of the inflation in Tanzania by scrutinizing the links between the fiscal operations, the money supply and the inflation. Having found a strong relationship among the three variables, he recommended the adoption of a more restrictive monetary policy in which the supply of money should be constrained to grow steadily at the rate of growth of reThe word ?Inflation? comes from the Latin “Inflatio’. It means increase, dilatation, expansion or blown up (Dictionary of economic Sciences, 2000) [32]. In most countries, the general level of prices tends to increase over time. This phenomenon is known as Inflation. Inflation means a sustained increase in the general price level of goods and services in an economy over a period of time. Inflation is an economy-wide phenomenon that concerns, first and foremost, the value of the economy?s medium of exchange. When the general price level rises, people have to pay more for goods and services. In another words, each unit of currency buys fewer goods and services. Alternatively, the price level can be viewed as a measure of the value of money. This implies that an increase in the price level means a less significant value of money that is the quantity of goods and services a given amount of money can buy decreases or a reduction in the purchasing power per unit of money which is a loss of real value in the medium of exchange and unit of account within the economy. Inflation is a continuous and sustained increase in the general prices of goods and services. Hence a one-time increase in the general price level cannot be classified as an inflation because it is expected to stabilize after their one-time leap. In another words, with no continuing expansion in the quantity of money, there can be no inflation. This is what Milton Friedman meant by his memorable aphorism “inflation is everywhere a monetary phenomenon.” Ludwig von Mises (1912) [33], a major figure in the Austrian school of economics, argued that inflation did not describe rising prices at all, but actually described an increase in the money supply. He supports that when a central bank, such as the Federal Reserve, performs open-market operations to increase the money supply in an economy, the extra money will be invested in an attractive sector of the economy. This will increase the prices in this sector and eventually throughout the economy. Unfortunately, the price increases do not represent an increase in real value, which means there will be an eventual "bust" to the investment bubble.

............

2.2 Theories of inflation

Some of the most frequently cited factors influencing inflation are those linked with the exchange rate management, or those that are monetary in nature and highlight the importance of the money supply and of policies to control the expansion of the money supply. Other models focus on structural factors, such as market imperfections and cost pressure from import price, whilst other emphasize demand pressures such as the government expenditure or the cost of government services, the amount of revenue collected , etc. Greene (1989) [37] has reviewed several approaches used to shed more lights on the inflation in African countries. The author classified then into: (a) monetarist approaches, (b) those that focus on the role of exchange rate depreciation either in conjunction with monetary policy or as influence on other factors feeding into the inflation, and (c) those centered on the fiscal model, more specifically on the fiscal deficits as the main cause of the monetary expansion. al output.

............

Chapter 3 Monetary policy framework in Madagascar ......... 18

3.1 Background of the Malagasy economy........ 18

3.2 Monetary policy framework ........ 21

3.3 Chapter summary ....... 26

Chapter 4 empirical Analysis of the Money Supply and Inflation in Madagascar ........ 27

4.1. Methodology ..... 27

4.2. Variables and Data ..... 28

4.3. empirical resuls .......... 28

4.4. Verification and explanation of Hypotheses ........ 32

4.5. Discussions and Implications ...... 36

4.6. Recommendations for Future Research ........ 36

4.7. Limitations of the Research ......... 37

4.8. Chapter summary ....... 37

Chapter 4 empirical Analysis of the Money Supply and Inflation in Madagascar

4.1. Methodology

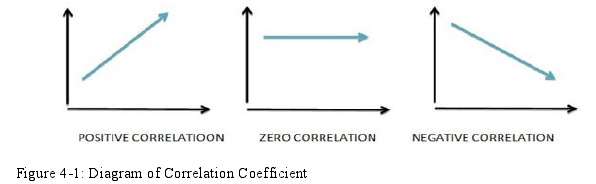

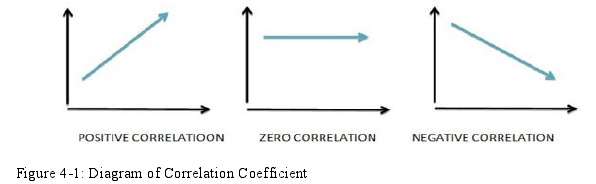

In this research study, we used secondary data collected from the National Institute of Statistics (INSTAT) in Madagascar, the World Bank data base, and at last, the Central Bank of Madagascar for the period between the years 1992-2012. The data gathered consists of the monthly observations for each variable from the year 1992 to 2012. In analyzing the collected data, the correlation coefficient - a quantitative measure that determines the degree to which two variable?s movements are associated, is expected to be exploited. It is hoped that positive significance will turn out to be the outcome, wherein r is expected to have a positive correlation.pearson?s correlation coefficient is the test statistics that measures the statistical relationship, or is the association between two continuous variables. It is known as the best method of measuring the association between variables of interest because it is based on the method of covariance. It gives information about the magnitude of the association, or correlation, as well as the direction of the relationship. The mathematical formula for computing r is as followed:

....

Conclusion

In this dissertation regarding the relationship between the money supply and the inflation in Madagascar, with the aim of finding the extent of how the monetary expansion can influence the price level, the researcher therefore conclude that:

(1) The multiple linear regressions method was used in the analysis of the stated influencing factors; it was proven that the more the money supply increase in the country, the greater bigger chance to experience inflation in the Malagasy economy. With the use of pearson?s correlation coefficient in finding out the level of impact the money supply on the price level in Madagascar, it has been found that there exists a strong and positive correlation between the variables. The money supply is therefore playing a significant role not only on the price level, but also on the economic performance of the country since the price stability is a crucial determinant of the economic stability in less developed countries.

(2) It was also found through the use of the linear regression method analysis and the pearson?s correlation coefficient that the Real exchange rate has also a positive impact on the inflationary process, even though the correlation between them less significant compared to that of the money supply and the inflation in Madagascar.

(3) Though the relationship between the variables have been confirmed by the correlation coefficient method, it can not help to determine if the relationship in question is a causal relationship or not. (4) The study suggested policies which aimed at properly formulating and implementing good monetary policies for a better control of the monetary expansion as well as a better management of the exchange rate. It is, therefore, recommended that constraining the growth in money supply, while maintaining a sustainable amount of money in the economy, should continue to be of paramount interest to the Central Bank of Madagascar, and the policy makers as whole.

.........

The reference (omitted)

相关阅读

- 香港离岸中心的发展对境内货币政策研究影响2016-12-07

- 中国通货膨胀驱动因素、省际传递及货币政策有效性研究2017-08-20

- 国际资本流动对我国货币政策影响研究2017-08-24

- 大萧条时期美国货币政策无效的主要原因探讨2018-01-07

- 引入媒介货币后中日汇率变动对双边金融贸易的影响2018-04-11

- 经济新常态下人民币国际金融化影响因素及测度研究2020-03-06